See the Future – Choose Your Future

Technology and business managers: How do you deal with technologies and markets that are further out in time? Do you think you can satisfy those markets only with breakthrough innovation? Is it possible to exploit future market and technical discontinuities to your advantage? Or will discontinuities continue to represent threats to your existing market position? This post shows you how you can see the future objectively and how that vision can expand your business choices and ultimately direct you to emerging technologies that someone – maybe you – will use to establish market leadership.

Spotting Significant Shifts in Commercially Valuable Technologies – In Advance

“My interest is in the future, because I am going to spend the rest of my life there”…quote from Charles Kettering, founder of Delco, former VP of GM Research Company

“The trouble with our times is that the future is not what it used to be”…Robert Frost, American poet

“It isn’t that they can’t see the solution. It’s that they can’t see the problem”…G.K. Chesterton, London-born 20th century writer

These quotes sum up quite accurately the realities that face forward looking technology and business managers: the future is too important to ignore; the future won’t be the same as the past; and future market needs are unclear. Taken together, these quotations philosophically express the drivers, risks and opportunities inherent in managing technology for future competitive business advantage.

Technology and business managers must embrace the future – they’ll be living in it soon enough. And they’re certain that no matter what the future holds, it will be different from the past and probably different from any linear projection of the present. And, as the backlog of technical innovations (the solutions) grows, so does the gap in understanding which of them holds the promise for commercial success (what problems these solutions can sustainably and profitably address). If managers could see clearly into the future, what exactly should they be looking for? For a start, we would want to see enough to allow us to project which technologies could contribute to competitive positioning and business impact and how they might do so.

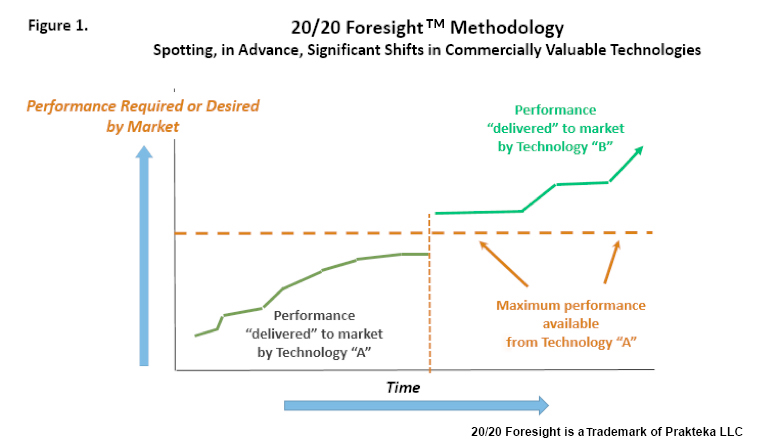

One key determinant of technology’s future: the evolution over time of the performance desired or required by a given end-use market. Thinking clearly about whether, how, and why a given performance requirement will change over time is fundamental to understanding which technologies could be commercial winners in the future.

Next, thinking objectively about the performance limits of existing technical solutions in the context of evolving end-use performance requirements leads to predictions of maximum tension in the technology supply/demand balance. A graphical representation of this technology supply/demand balance is shown in Figure 1. Figure 1 illustrates that Technology “A” shifts to Technology “B” at the point where A reaches the limits of its ability to deliver against functional market requirements and B exists to fill the gap.

An Example: Why the “Performance” Axis Counts Most

To help make the concept of 20/20 Foresight more real, let’s consider an example: passenger car tires made for and sold to US automotive original equipment manufacturers (OEMs) by US tire manufacturers. In this example, we’ll define technology “A” as “bias” ply and technology “B” as “radial” ply. Bias tire technology and radial tire technology can each be unbundled into a number of associated component technologies, e.g., material, design, process, and equipment technologies. Each component technology has its own “20/20 Foresight” diagram. For the purpose of this example, however, we’ll remain at the higher, engineered and fabricated product level of “bias” vs. “radial” tires.

Furthermore, in this example, we’ll define “performance” (the y-axis) as the sum total of all performance demands made by US OEMs on passenger car tires. Performance demands fall principally into one or more of the following categories: increased tire service life; increased safety; reduced energy consumption; improved ride.

Back in the 1950’s and 1960’s, US tire makers were reveling in the innovations that allowed them to meet the ever increasing demands on tire performance from the automotive makers, their immediate downstream customers. Advances in materials (e.g., introduction and availability of synthetic rubbers; of tailored carbon blacks); in tire design (migration of bias tires to bias belted tires); and in process equipment and know-how (contributing to greater product uniformity) had advanced the passenger car tire product to the point where warranties were approaching 30,000 miles service life. Not long after, industry insiders began hearing whispers of the “100,000” mile tire! For those who were caught in the bias tire world, a “100,000” mile tire, under any set of normal driving conditions, seemed impossible. Yet, if it were possible, what would that do to the existing industry? Existing materials and designs indeed could not deliver such an extended lifetime. After all, a 100,000 mile tire implied 5-10 years of driving without a tread going “bald,” without sidewalls failing, without underinflation or overinflation causing failures related to heat build-up within the plies. What technologies could deliver that performance?

Entire Value Chain Affected: “Coordinated Innovation” Essential to Commercialization

As we know, radial tire technology was the solution to the “100,000” mile problem/opportunity! Radial tire technology revolutionized the tire industry globally – everyone in the value chain was affected. Radial tire constructions delivered breakthrough performance and, at the same time, required breakthrough performance in their enabling and component technologies (e.g., adhesion of steel reinforcing cords to rubber). Existing investments in bias tire production equipment, from raw material processing to tire building to tire curing, were not applicable to the production of radial tires. Bias tire production lines became “cash cows” in the best cases; bias tire plants became candidates for closure in the worst cases.

Uniroyal was one of the US domestic tire companies to make the decision to transition to the new, revolutionary radial tire technology. That decision was based on a number of factors, but its ability to do so was based on one critical business factor: it had a commercial commitment to the US automotive OEMs as a customer base. Indeed, Uniroyal enjoyed a favored position as a tire supplier to General Motors. The commercial relationships were multilevel, which meant timely and direct multilevel access to ever evolving customer performance requirements and specifications. Moreover, radial tires were not a “drop in” replacement for bias tires in new cars – US auto makers had to re-engineer cars to realize the performance advantage potential inherent in radial tires. So “coordination” in innovation – innovation in radial tires as well as innovation in car design – was a necessary condition for the commercialization of radial tire technology in the US. Uniroyal’s close relationship with General Motors helped facilitate such coordination. In effect, Uniroyal could “see the future” of US OE passenger car tires and became an indispensable partner to its downstream customers to help them set the pace for performance improvements.

Technology Alone is Not Enough

In 1969, Uniroyal chose to build the world’s then-largest radial-only tire plant in Ardmore, Oklahoma, to serve its US automotive and aftermarket customers. Although radial tire technology was revolutionary to US automakers and their tire suppliers in the 1970s, it was not a new technology. Michelin filed a patent for the radial tire in 1946 and introduced radials into commercial production in 1948. By the mid 1950’s, most of the European automotive industry had adopted radial technology. Uniroyal’s own European operations had started the production of radial tires in the late 1950’s. Rather, it was the convergence of market need with the technology solution that paved the way for the complete transformation of the US OE and aftermarket tire industry. Radial technology alone was not enough. Consider this issue from Michelin’s perspective: by the time Uniroyal’s first US radial tire plant was opened, 98% of tires sold in France were already radials. Close to two-thirds of those were supplied by Michelin. Yet, it wasn’t until 1985, almost 40 years after Michelin filed the first patent on the radial tire, and 10 years after opening its first US production plant, that Michelin’s share of the US market topped 10%. Clearly, radial tire technology by itself did not define the rate or extent of market penetration.

The Future May “Impel” but it Doesn’t “Compel”

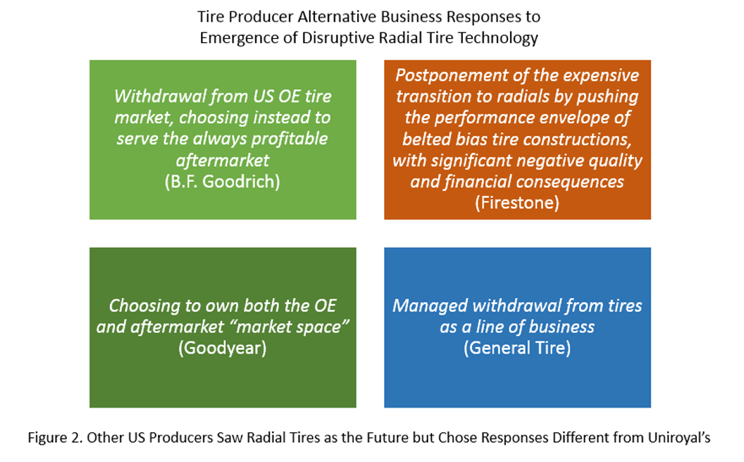

When Uniroyal looked at the future of passenger car tires, it saw clearly that changes in its automotive OE base would lead inexorably to the rapid adoption of radial tire technology throughout the US. Other US tire producers saw the same future, but they chose a response different from that of Uniroyal. Figure 2 illustrates that identical (and correct) visions of the future can produce a number of different alternative business responses to it. The availability of radial tire technology enabled certain business choices, but just as certainly compelled none of them.

For a superb “hindsight” analysis of the US tire industry, including the technology/business interface issues related to the emergence of disruptive radial tire technology, please see “The Eclipse of the U.S. Tire Industry,” by Raghuram Rajan, Paolo Volpin, and Luigi Zingales, http://www.nber.org/chapters/c8649.pdf

Using 20/20 Foresight to See Your Future

20/20 Foresight is applicable to every technology that is being applied or might be applied to a current or future market need. Seeing the commercially valuable problems clearly is the first step toward seeing the future. Seeing clearly and correctly requires awareness and knowledge of the issues that matter with respect to technology adoption and commercialization. The more you know, the more insights you have, the better you understand how technologies enable performance and response to market needs, the clearer your view of the future. How to choose your technical and business response to that future is just that: your choice! And it’s a choice that depends on much more than just your current or future technology options.

For a no obligation discussion about how 20/20 Foresight can help you in your business-critical decisions, please contact us using our inquiry form on the Contact Us page or simply email your inquiry to mah@www.prakteka.com

20/20 Foresight is a Trademark of Prakteka LLC